Send & Receive Money Anywhere in the World

If you need to move money quickly and securely — nationally or internationally — look no further than Community State Bank’s Wire Transfer Services.

Wire transfers allow for the same-day movement of funds between banks. CSB can manage the following wire transfers:

- Incoming domestic

- Outgoing domestic

- Incoming international

- Outgoing international

When you wire money, collected funds are credited to other banks the same day that the wire is originated. An outgoing wire request must be received prior to 3 p.m. to ensure the recipient receives same-day credit.

Fees apply.

Wire Transfer Notice

Effective July 14, 2025, the Federal Reserve is undergoing a significant change with the adoption of ISO 20022 messaging standard. This change aims to standardize payment messages, improve data exchange and reduce errors.

Customers with Online Wire Transfer Access

If you are a customer who uses the online banking wire transfer platform, it is necessary to ensure that all the required data is included in the templates you have stored in the system. Please confirm that you have addresses completed for all of the required fields including the Creditor Agent (Receiving Bank), Creditor (Person or Business receiving the funds) and, if applicable, the Intermediary Agent.

What changes are taking place?

With the adoption of ISO 20022, the wire transfer process will be standardized across all banks and some information that was previously optional will now be required. Additionally, the terminology included with wire instructions will be updated to ensure consistency and reduce errors. Below are some of the terms that will be updated:

| Old Term | New Term | Definition |

|---|---|---|

| Sending Bank | Instructing Agent | The financial institution (bank) that is sending the funds. They submit the information to the Fedwire system. |

| Receiving Bank | Instructed Agent | The financial institution (bank) that is receiving the funds from the Fedwire system. |

| Intermediary Financial Institution | Intermediary Agent | A “middleman” between two banks in a financial transaction, facilitating the flow of funds between them. |

| Originating Financial Institution | Debtor Agent | The bank where the sender holds their accounts. |

| Beneficiary Financial Institution |

Creditor Agent |

The bank where the recipient holds their accounts. |

| Originator | Debtor | The person or business sending the funds. |

| Beneficiary | Creditor | The person or business receiving the funds. |

How to Make a Wire Transfer

Required Wire Information

To Send a Wire Transfer, please collect all the following information:

- Creditor Agent (Receiving Bank)

Name, Address and Routing (ABA) Number - Creditor (Beneficiary – The person or business who is receiving the funds)

Name, Address and Account Number - If there is an Intermediary Agent, please collect the following information:

Name, Address and Routing or Account Number

Receiving a Wire Transfer

To Receive a Wire Transfer, please use the incoming wire transfer instructions below or contact your banker at (262) 878-3763.

Online Banking

You can initiate wire transfers through Business Online Banking. Our Wire Transfer Agreement allows you to specify who, within your organization, is authorized to submit wire requests. A call-back verification process is implemented prior to releasing funds to further protect your accounts.

(If you haven’t enrolled in Online Banking yet, contact us to get started.)

In Person

Wire transfers can also be made at any of our locations.

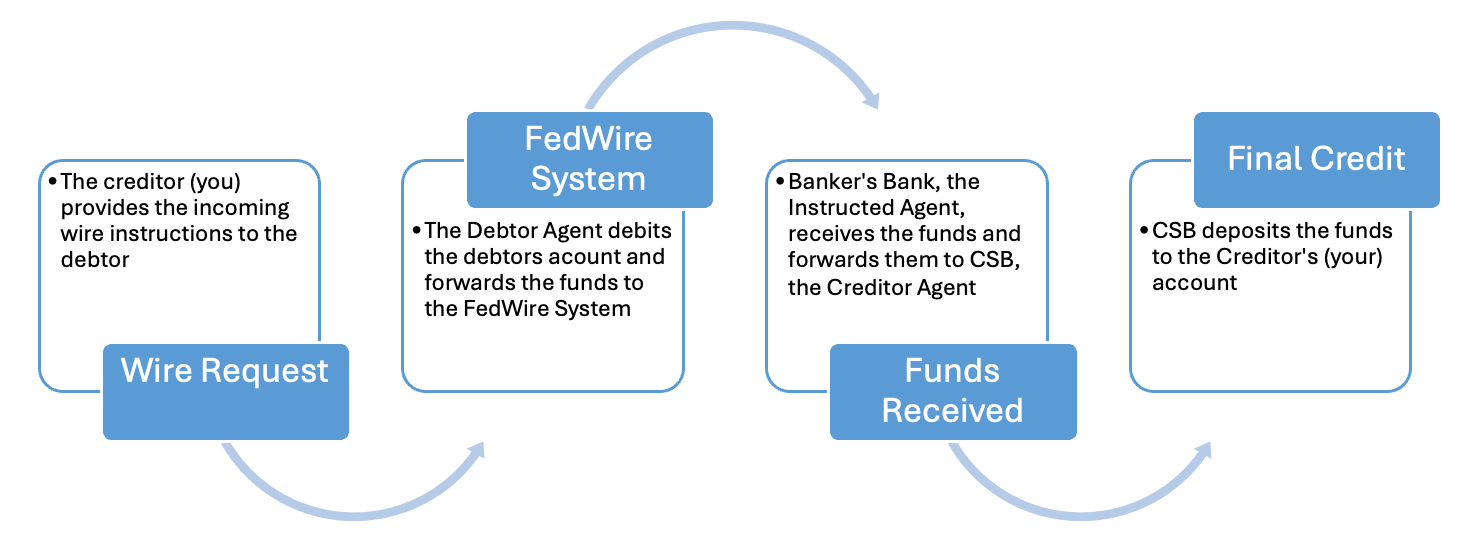

Path of an Incoming Wire Transfer to CSB

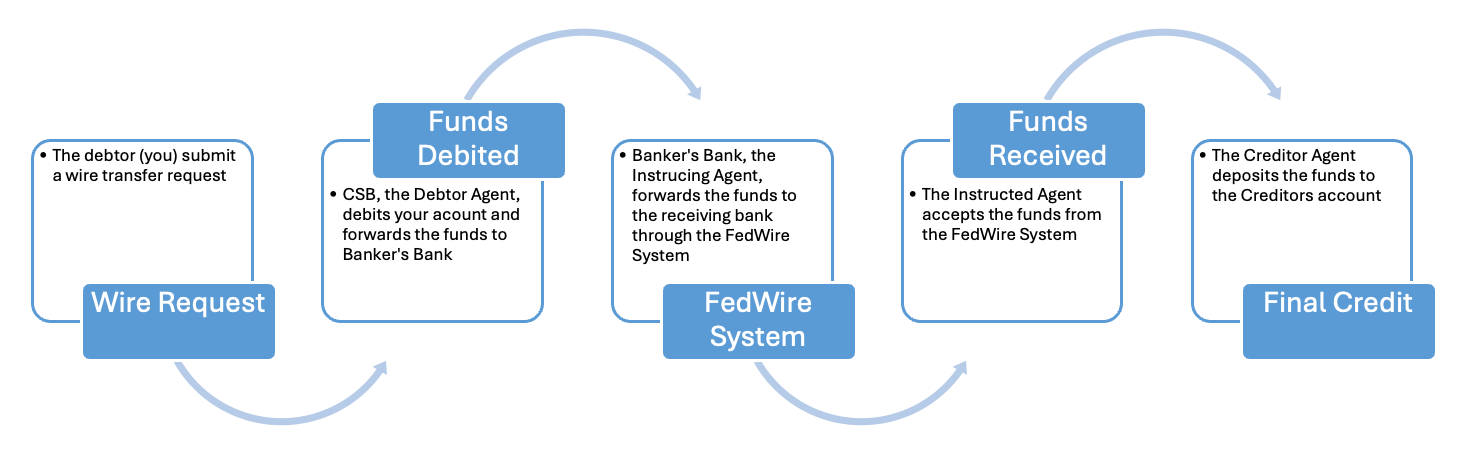

Path of an Outgoing Wire Transfer from CSB