Fraud Prevention System

Protect your business from fraud with Community State Bank’s Positive Pay service. Easily detect counterfeit and fraudulent checks when you submit an electronic file detailing the checks your business issues.

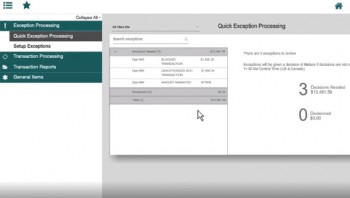

When each check is presented for payment, the Positive Pay system electronically compares it to the information in your file. Any discrepancies are flagged and reported through a special email alert and reviewable through your eBusiness Banking service.

This verification method protects businesses against some of the most common check fraud schemes, intercepting a fraudulently written check before it impacts your account.

Positive Pay Benefits

Fraud Prevention

- Minimizes the potential of fraudulent check activity

- Scans authorized checks for payment accuracy

- Scans for fields that do not match the issue file

- Scans for duplicate checks

- Emails alerts of unauthorized transactions

- Allows businesses to return unauthorized transactions

Easy-to-use Interface

- Use eBusiness Banking to import your issued check files or enter the data manually.

- Suspect items are available by 7 a.m. CST, and designated users are notified by email.

- Images of suspect items are available via Business Online Banking.

- Pay or return decisions must be completed by 11 a.m. CST.

- Issued check information is updated to branch network on a real-time basis.

Contact Our Cash Management Team to Get Started